It’s here — Trump’s 50% tariffs on India. So, where do India’s exporters go from here? For some of India’s biggest exporters, the answer is any which way that helps them survive the biggest business shock of their entrepreneurial career.TOI spoke to companies across sectors for this story. Some companies trying to find solutions is sort-of-good news. The bad news is that finding alternatives won’t be easy, smaller exporters’ adjustment capacity is limited, and the negative impact on jobs in export companies is already visible.Discount strategyAgra-based Puran Dawar of Dawar Group is offering discounts to ensure old clients continue sourcing formal and smart casual footwear from his company. So is Israr Ahmed, director of Farida Group, one of India’s largest footwear exporters, with big brand international clients. The idea is to keep buyers engaged, lest they move to other suppliers.In Gurgaon, Sudhir Sekhri, a large garment exporter who also heads the Apparel Export Promotion Council, is willing to offer discounts till the tariff issue is “resolved”. Export contracts are being devised in a way that the discount will be withdrawn in case Trump decides to drop the additional 25% tariff.“If you can sell, sell it at cost, at least the incremental quantity,” said Pankaj Chadha, who leads the Engineering Export Promotion Council.“This is a temporary challenge. We will operate at zero margin for a few months and get a little hurt… but that is better than letting your client go away,” said Dawar.Other markets: Abroad & hereDawar, aside from offering discounts, is scouting for opportunities outside America. He’s focusing on Russia and other CIS countries, as well as on Latin America. Another leather goods exporter, who did not want to come on record, said he had been to China at the start of the month, hoping to find buyers for some of his products.Jewellery makers such as Colin Shah are looking “inward”, trying to sell more in the domestic market. Arun Kumar Garodia, who runs Kolkata-based Corona Steel Industries, is also eyeing the domestic market, plus exploring markets in Latin America and Africa.Exporters know these aren’t easy options. As Garodia said: “A lot of products we export to the US don’t have so much demand in India. In markets like Africa, there are concerns with payments.” His best bet? That the 25% extra tariffs won’t last very long.Govt, too, is stepping in, at least in some sectors. It’s working towards connecting exporters with large global chains, hoping that some exports can be diverted. The Centre is also trying to assess from American buyers how the pain can be reduced for Indian exporters.Anand of Anand Inc, a Noida-based garments exporter, said that trade deals with the UK and the one proposed with EU will open new markets.FIEO director general Ajai Sahai, however, cautioned that diversification won’t be easy. China has already moved in a big way in markets such as Europe.

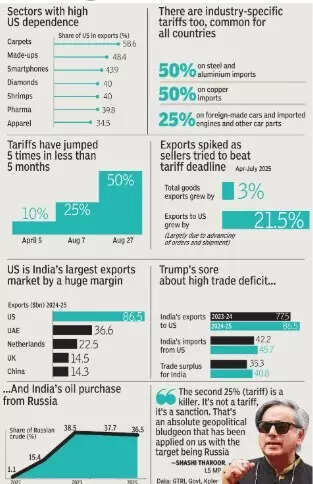

Selling before tariffs hitFrom big exporters like Bharat Forge and Gokaldas to smaller players in Ghaziabad and Ambur, the last 20 days have been frantic — frontloading shipments to the US. Farida Group’s Ahmed said that his companies prioritised dispatches to American ports to beat the 50% tariff rate.Shrimp exporters have exported more in July and Aug to beat the tariff deadline. Same for gems and jewellery exporters, who wanted to ensure their supplies were sold at lower duties, so that those products can be on retail shelves before the holiday season.“T-shirts that cost $12 or $15 in US markets have been airlifted by buyers,” said Ashwani Aggarwal of Ludhiana-based Nahar Industries.

.

Near future still looks bleakBut all these efforts won’t substantially reduce the hurt. As Aggarwal says, there’s no clarity on future orders from the US, because the 50% tariff is “too high”. The other problem is that buyers in alternative markets know Indian exporters are in a tough situation. As a garment-maker, who did not want to come on record, said, buyers in European countries will now drive a hard bargain.Unsurprisingly, the first adverse impacts on jobs and entrepreneurs are already showing.One fallout of large exporters hunting for alternative markets may be on smaller exporters, who will now have to compete with bigger domestic rivals for the same set of buyers.But more immediately, the bad story is playing out in jobs. Some dyeing units in Tirupur are now working five days a week, but if the tariff problem persists, supply cycles and demand for labour will have to be recalibrated, said a garment industry player, who spoke off the record.There are reports of looming layoffs in gems and jewellery and garment exporting companies. Overtime in some shrimp processing units in Andhra has stopped. A jewellery industry executive, who spoke off-record, said the number of contract workers employed is coming down because there are no new American orders. Exporters will hold on to permanent skilled workers until at least Dec, he said.But if Trump’s 50% tariff persists, things can get much worse.